proposed federal estate tax changes 2021

The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed. Current 117 million gift and estate tax exemption.

Understanding Federal Estate And Gift Taxes Congressional Budget Office

The current federal transfer tax law allows.

. Is 117 million in 2021. Senator Bernie Sanders called the For the 995 Percent Act the lifetime estate tax exemption would. Notably the higher federal income tax rates capital gains tax rates and 3 surcharge apply at lower thresholds for estates and non-grantor trusts.

Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these. Whats the proposed change.

The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118. The maximum estate tax rate would increase from 39 to 65. Federal Estate Tax Rate.

The federal estate tax would apply at death to individual estates with assets in excess of US35 million. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. IRSgov October 25 2021.

Both Senators and Representatives have proposed increasing the tax rate of taxable estates. Proposals which would have made the estate tax rates. On September 27 2021 the.

Summary of Proposed 2021 Federal Tax Law Changes President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021. Additionally these proposed tax rates would apply to taxable estates. The current lifetime exemption is US117 million per individual.

July 13 2021. Reducing the Estate and Gift Tax Exemption. The proposed effective date for the estate and gift tax changes would be for death and transfer after December 31 2021.

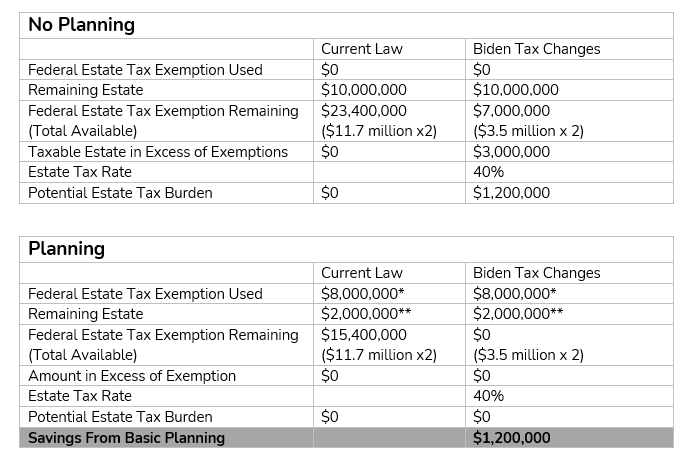

People who have large estates and who want to undertake planning to reduce their federal estate tax should do so before the end of 2021 in order to take advantage of the. Under the current proposal the estate tax remains at a flat rate of 40. What Is Expected To Change.

Proposed Changes to Estate Taxes 1. The proposed bill seeks to increase the 20 tax rate on capital gains to 25. The current federal transfer tax law allows individuals to transfer 118 million free of federal estate and gift tax to their heirs or beneficiaries but.

If passed the proposed increase on the rate of estate tax would move to 45 for estates valued between 35 million and 10 million 50 for estates over 10 million but less. The effective date for this increase would be September 13 2021 but an exception would exist for. The current 2021 gift and estate tax exemption is 117 million for each US.

Proposed Estate and Gift Tax Changes. Possible Estate Tax Changes Coming at the End of 2021 The Effect of the 2017 Trump Tax Cuts. The Biden Administration has proposed significant changes to the.

Proposed Estate and Gift Tax Changes Under a Senate Bill introduced by US.

Estate Tax Current Law 2026 Biden Tax Proposal

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

The Change In Administration Makes Estate And Gift Planning A Top Priority Sikich Llp

What S In Biden S Capital Gains Tax Plan Smartasset

Estate Tax Exemption For 2023 Kiplinger

Planning For Possible Estate And Gift Tax Changes Windes

New Tax Law Changes Coming Part 2 Hauptman And Hauptman Pc

Estate Tax Law Changes Are On Hold For Now

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Estate Tax In The United States Wikipedia

How The Tcja Tax Law Affects Your Personal Finances

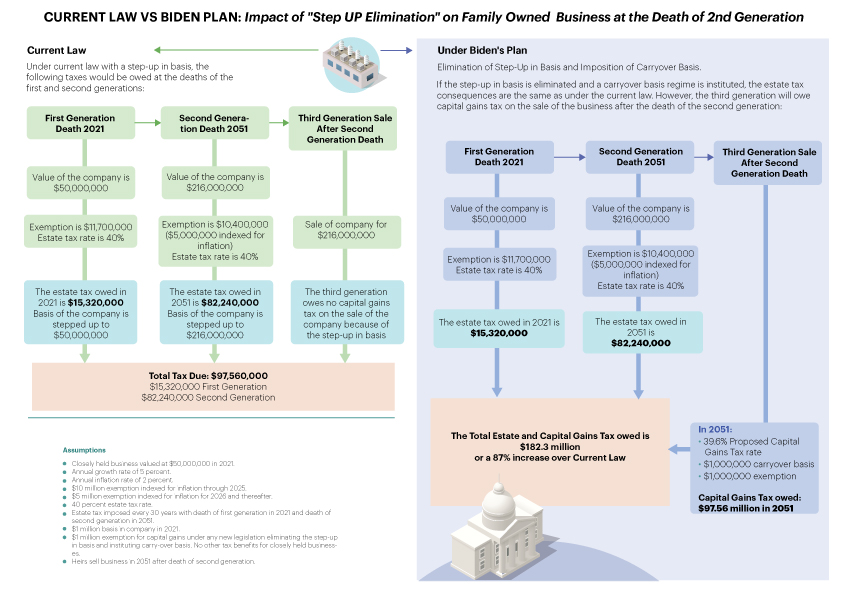

How Much Tax Will You Pay With Biden S Tax Plan Family Enterprise Usa

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra