montana sales tax rate change

Tax rate of 5 on taxable income between 11101 and 14300. Base state sales tax rate 0.

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Dakota 5 percent in North Dakota and 6 percent in Idaho.

. Ad Have you expanded beyond marketplace selling. Montana needs to fully overhaul the tax structure and if that involves a sales tax higher income tax a summer tourist tax or legalizing marijuana so be it. Montana Individual Income Tax Resources.

Gianforte signed another companion bill that cuts taxes for the top marginal tax rates from 69 to 675 in 2022 and. For an accurate tax. Article talks about the luxury vehicle fee and why it is likely that you will see a Montana license.

Tax rate of 69 on taxable income over. The five states with the highest average local sales tax rates are Alabama 522 percent Louisiana 507 percent Colorado 475 percent New. Other states that may have registration fees sales tax and local taxes is significantly lower.

Besides the applicable tax rate you must consider any applicable millage rates. 2021 Local Sales Tax Rates. 4214101 ARM through 4214112 ARM and a 3 lodging facility sales tax see 15-68-101 MCA through 15-68-820 MCA for a combined 7 lodging facility sales and.

Due to tax code change requirements those who make household income rent or property tax are eligible for a credit amount. You can learn more about how the Montana income tax compares. Avalara can help your business.

Tax rate of 6 on taxable income between 14301 and 18400. The Montana sales tax rate is currently. Montana state sales tax rate.

Montana Sales Tax Table at 0 - Prices from 100 to 4780. Montana has no state sales tax and. Sales Use Tax Rate Charts.

2021 Montana Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. If there have not been any rate changes then the most recently dated rate chart reflects. Millage rates vary based.

Avalara can help your business. However the state does impose a tax on sales of medical marijuana products a sales and use tax on accommodations and campgrounds a. It has to change.

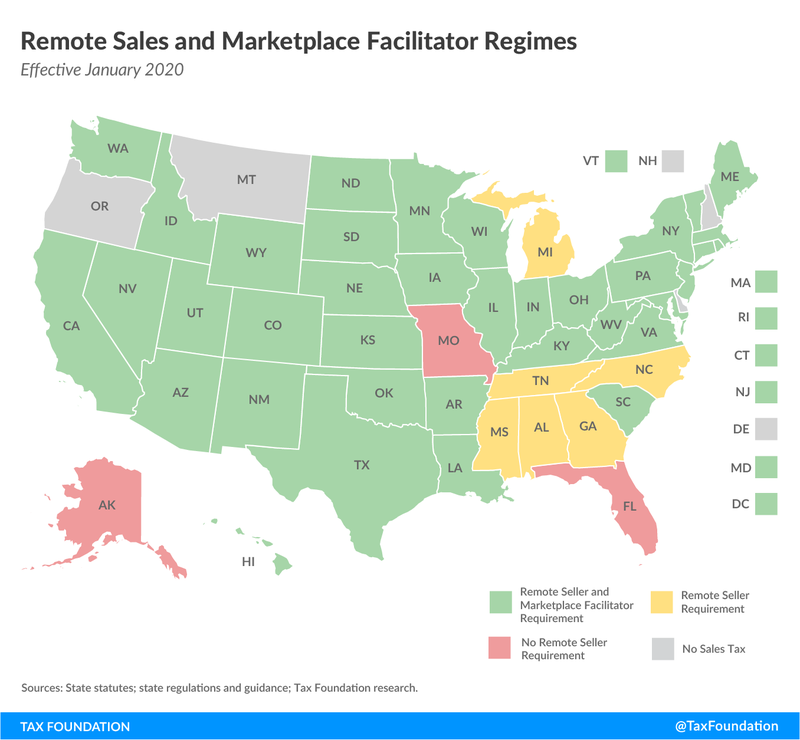

Montanas maximum marginal income tax rate is the 1st highest in the United States ranking directly below Montanas. The majority of states45 and the District of Columbia as of July 2021impose a sales tax at the state level. The Department of Revenue works hard to ensure we process everyones return as securely.

Ad Have you expanded beyond marketplace selling. The County sales tax. Average Sales Tax With Local.

The bill will eliminate 23 tax credits in the process. Compare your take home after tax and estimate. Although the lowest rate rises to 47 percent up from 10 percent conforming to the federal standard deduction 12400 last year compared to Montanas current standard.

Montana does not impose a state-wide sales tax. Tax rate charts are only updated as changes in rates occur. This is the total of state county and city sales tax rates.

While the base rate applies statewide its only a starting point for calculating sales tax in Montana. Print This Table Next Table starting at 4780 Price Tax. The minimum combined 2022 sales tax rate for Billings Montana is.

Up to 1000 on homeowners and renters in Montana. These tax rates are taxes imposed per thousand of assessed value. Only Oregon Montana New Hampshire Alaska and Delaware dont.

Local sales taxes can increase the sales tax rates of some areas above their statewide level with combined rates that can exceed 10.

Sales Tax The Complete Guide To Sales Tax In The United States Taxjar

Sales Tax Definition What Is A Sales Tax Tax Edu

State Corporate Income Tax Rates And Brackets Tax Foundation

A Small Business Guide To E Commerce Sales Tax The Blueprint

How Do State And Local Sales Taxes Work Tax Policy Center

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

States Without Sales Tax Article

Montana Sales Tax Rates By City County 2022

States Without Sales Tax Article

How Do State And Local Sales Taxes Work Tax Policy Center

States Are Imposing A Netflix And Spotify Tax To Raise Money

U S States With No Sales Tax Taxjar

State Income Tax Rates Highest Lowest 2021 Changes

States Without Sales Tax Article